So tax season is here again, and you need your W2 from your former or current employer, Walmart, to file your taxes. As one of the largest companies in the U.S. with over 2 million employees, Walmart has a process in place to provide current and past employees with their annual W2 wage and tax statement forms.

Don’t worry, getting your Walmart W2 is pretty straightforward if you know the steps. In this article, we’ll walk you through exactly how to get your W2 from Walmart, whether you still work there or left the company years ago.

By the end of this guide, you’ll have your W2 in hand and be ready to file your taxes accurately and on time. Let’s get started!

- What Is a W2 Form and Why Do You Need It From Walmart?

- How to Get Your Walmart W2 Online as a Current Employee

- Requesting Your Walmart W2 by Mail as a Former Employee

- Troubleshooting Problems Getting Your W2 From Walmart

- Where Can I Find EIN On My Walmart W-2?

- Frequently Asked Questions About Walmart W2 Forms

- Conclusion

What Is a W2 Form and Why Do You Need It From Walmart?

So you worked at Walmart last year and now tax season is here. To file your taxes, you’ll need some crucial forms from your former employer, including the W2.

What exactly is a W2 form?

A W2 form, also known as a Wage and Tax Statement, shows how much you earned and the taxes withheld from your paycheck over the year. Walmart is required by law to provide you with an accurate W2 form for your tax records and filing.

To get your W2 from Walmart, here are the steps to follow:

- Check your mail in January. Walmart will mail W2 forms to employees’ home addresses before January 31st. If you’ve moved recently, log into Walmart’s employee website and update your personal information with your current mailing address.

- Look for it on Walmart’s employee website. You may be able to access an electronic version of your W2 on Walmart’s employee portal. The website address and login info can be found on past paystubs.

- Contact Walmart’s payroll department. If you haven’t received your W2 by mid-February, call Walmart’s payroll helpline and request a copy. They can mail out a replacement or advise on the next steps to get one.

- As a last resort, you may need to request an IRS Wage and Income Transcript. This transcript serves the same purpose as the W2. You can request one on the IRS website, by phone, or by filling out Form 4506-T.

The W2 from Walmart contains important tax information, so make sure you get one for your records and to file your taxes accurately. Let Walmart’s payroll department know right away if there are any errors on your W2 so they can issue a corrected form. Following these steps will help ensure you have a smooth tax filing experience.

Understanding the Walmart W2 Form Boxes

Now, let’s delve into each of these boxes to better understand what they represent.

| Box Name | Explanation |

|---|---|

| Box A | Social Security Number |

| Box B | Employer Identification Number (EIN) |

| Box C | Employer’s Name and Address |

| Box D | Control Number (if Assigned) |

| Box E | Employee’s Full Name |

| Box F | Employee’s Address |

| Box 1 | Total Wages and Tips Earned |

| Box 2 | Federal Income Tax Withheld |

| Box 3 | Social Security Wages |

| Box 4 | Social Security Tax Withheld |

| Box 5 | Medicare Wages and Tips Earned |

| Box 6 | Medicare Tax Withheld |

| Box 7 | Social Security Tips Earned |

| Box 8 | Allocated Tips |

| Box 9 | Other Employee Benefits No Longer Available |

| Box 10 | Dependent Care Benefits |

| Box 11 | Non-Qualified Plans |

| Box 12 | Compensation or Reductions to Taxable Income |

| Box 13 | Statutory Employee, Retirement Plan, Third-Party Sick Pay |

| Box 14 | Additional Tax Information |

| Box 15 | Employer’s State ID Number |

| Box 16 | State Wages, Tips, and Compensation |

| Box 17 | State Income Tax Withheld |

| Box 18 | Local Wages, Tips, and Compensation |

| Box 19 | Local Income Tax Withheld |

| Box 20 | Locality Name |

How to Get Your Walmart W2 Online as a Current Employee

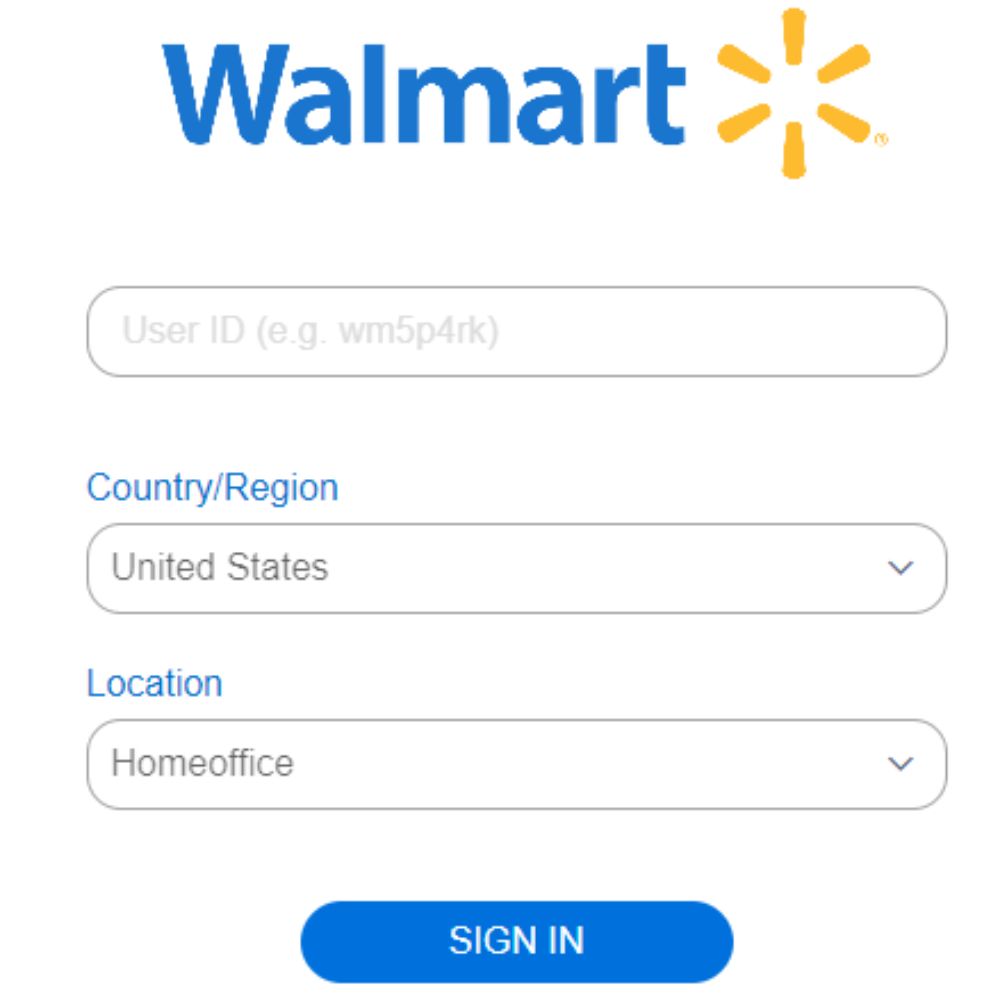

As a current employee of Walmart, you can access your W2 tax forms online through Walmart One, Walmart’s employee portal. Here are the steps to get your W2:

To log in to Walmart One, you’ll need your WIN (Walmart Identification Number) and password. Once logged in, hover over the “Pay” menu and select “W2 Tax Form”.

You’ll see a list of tax years for which W2s are available. Click the link for the most recent tax year.

Your W2 will open as a PDF. Double-check that all the information like your name, address, Social Security number, and earnings are correct. If everything looks right, you can print or download the PDF to your computer.

If there are any errors on your W2, contact the Payroll Department right away. They can re-issue a corrected W2 with the proper information. It’s important that the details on your W2 match what you report on your tax return.

Now you’re ready to use your Walmart W2 to file your taxes. Whether you file online using tax prep software, work with an accountant or tax professional, or fill out paper tax forms, be sure to include all the information from your W2 accurately.

Following these steps will ensure you get your Walmart W2 in a timely manner and are able to file complete and accurate tax returns. If at any point you run into issues accessing or downloading your W2, don’t hesitate to contact Walmart’s Payroll Department for help. They’re there to assist you and make sure you have everything you need.

Requesting Your Walmart W2 by Mail as a Former Employee

To request your W2 from Walmart as a former employee, follow these steps:

As a past employee of Walmart, you’ll need to request your W2 tax form to use when filing your taxes. Don’t worry, it’s a straightforward process to obtain your W2 whether you need it mailed or prefer an electronic copy.

Request by Mail

If you want your W2 mailed to you, call the Walmart Associate Information Line at 1-800-421-1362. Provide information like your name, social security number, store location, and the years you were employed. Walmart will verify your information and mail your W2 to the address you provide within 7 to 14 business days.

Make sure you allow adequate time for your W2 to arrive before the tax filing deadline. Once received, double-check that all the details on your W2, such as your name, social security number, wages, and taxes withheld are correct before using it to file your taxes. If anything looks inaccurate, contact Walmart right away to request a correction.

To request a replacement or reissued W2, you’ll need to provide a signed request in writing to:

Walmart Inc.

ATTN: W2 Research and Reissue

508 SW 8th Street

Bentonville, AR 72716-0555

Be sure to include details like your full name, social security number, store location, dates of employment, and the reason you’re requesting a reissued W2. Walmart aims to process these requests within 2 weeks, so plan ahead if you need your W2 reissued.

Whether choosing electronic or mail delivery of your Walmart W2, the important thing is allowing enough time to obtain it and ensuring all details are correct before filing your taxes. Let Walmart know right away if you have any issues receiving or correcting your W2.

Troubleshooting Problems Getting Your W2 From Walmart

If you run into issues obtaining your W2 from Walmart, don’t worry, there are a few steps you can take to troubleshoot and get your tax documents.

Check Your Mail and Online Account

First, double-check that your W2 isn’t already on the way or available to download. Form W2s are mailed out by January 31st each year. It can take up to a week for it to arrive, so give it until at least the second week of February before worrying. You should also log into Walmart’s associate website where you’ll find your paystubs and tax information. Your electronic W2 may already be posted there ready to download and print.

Call the Walmart Associate Hotline

If after a couple of weeks, you still haven’t received your W2 in the mail or online, contact Walmart’s associate support hotline. Let the associate know you have not yet received your W2 for the previous tax year. They should be able to look into the issue, confirm your current mailing address on file, and potentially issue you a reprint of the form. The hotline is available 24 hours a day, 7 days a week to help resolve these types of issues.

File for an Extension

In the unlikely event Walmart is unable to issue your W2 in a timely manner, you may need to file for an automatic tax extension with the IRS to avoid potential penalties. Filing for an extension gives you until October 15th to submit your tax return. You will still need to estimate your tax liability for the previous year and pay any amount due. Then, once you receive your W2, you can submit your final tax return.

Contact the IRS

If all else fails and you do not receive your W2 by the extended October deadline, you may need to contact the IRS directly. Provide details about your attempts to get the issue resolved with Walmart to date. The IRS can work with Walmart on your behalf to track down the missing W2. They can also potentially help determine alternative ways to report your income if Walmart is unable to issue a replacement W2. The IRS should be an absolute last resort, so make every effort to work with Walmart first before contacting them.

Where Can I Find EIN On My Walmart W-2?

To locate your Walmart Employee Identification Number (EIN) on your W-2 tax form, here are the steps:

Check Box B on Your W-2

On your W-2 form, look for Box B, titled “Employer’s identification number.” This box will contain your 9-digit EIN, also known as your tax ID number. Walmart’s EIN is 71-0415188. Your personal EIN will be different and unique to you as an employee.

Why Do You Need Your EIN?

Your EIN is important for tax filing purposes, as the IRS uses it to identify your W-2 and ensure your employer (Walmart) submits an accurate wage and tax statement. You will need to provide your EIN when filing your tax returns or enrolling in employee benefits.

How to Get Your W-2 if You Can’t Find It

If for some reason you can’t locate or access your W-2, don’t worry. There are a few ways to get a replacement:

- Log in to one.walmart.com, the employee portal, and access your pay statements. Your W-2 will be available for download here, typically by the end of January.

- Contact your local Walmart store and speak to someone in personnel or payroll. Provide your name, address, Social Security number and they can issue you a reprint of your W-2.

- As a last resort, you may need to contact the IRS directly to request an IRS Wage and Income Transcript. This will provide you with the details from your W-2 so you can file your taxes. You can request a transcript on the IRS website, by phone, by mail, or in person. Be prepared to verify your identity.

Following these steps, you should be able to quickly locate your EIN on your W-2 form or obtain a replacement if needed. Let me know if you have any other questions!

Frequently Asked Questions About Walmart W2 Forms

Once you’ve logged in to Walmart’s employee website and accessed your W-2 tax form, you may still have some questions about what the various boxes and codes mean. Here are some of the most frequently asked questions about W-2 forms from Walmart:

What do the different boxes on the W-2 represent?

- Box 1: Shows your total taxable wages and income for the year. This number is used to calculate your income taxes.

- Box 2: Reports the federal income taxes that were withheld from your paychecks.

- Box 3: Displays your Social Security wages. The amount of Social Security tax withheld is shown in Box 4.

- Box 5: Shows your Medicare wages and the Medicare tax withheld is shown in Box 6.

- Box 10: Reports any dependent care benefits you received that are excludable from your income.

Why are there more than one W-2 form?

If you worked at multiple Walmart locations or in different states during the tax year, you may receive separate W-2 forms for each location or state. The income and withholdings will be reported separately based on where the wages were earned. Make sure you provide all W-2 forms when filing your tax return.

How do I get additional W-2 copies or reissue a lost W-2?

To request additional copies of your W-2 or if you lose your original W-2 form, you can:

- Log in to Walmart’s employee website and access your digital W-2. You can print copies from there.

- Contact Walmart’s payroll department and provide your name, employee ID, social security number, or mailing address to request replacement copies. There may be a small fee for reissuing W-2 forms.

- As a last resort, you may need to file IRS Form W-2c to receive corrected or replacement W-2 forms if other options are unavailable.

Why haven’t I received my W-2 yet?

W-2 forms are mailed out by January 31st. If you have not received your W-2 from Walmart by early February, double-check that your mailing address on file is correct. There may also be processing delays. You should contact Walmart’s payroll department directly for assistance. They can provide you with information on the status of your W-2 and help resolve any issues.

Conclusion

So that’s it. You’re all set with how to get your W2 from Walmart. It’s not too complicated but following the proper steps will ensure you have the necessary tax documentation in hand come tax season.

Whether you’re still employed with Walmart or have moved on to bigger and better things, accessing your tax forms is important for staying on the right side of the IRS. Now you can rest easy knowing exactly how to get your W2 and avoid any unwanted penalties or issues.

Take care of this small but important task and then get back to more exciting things – like planning your next vacation or tackling that home renovation project you’ve been dreaming about!

The possibilities are endless once you have peace of mind about your taxes.