Are you looking to grow your money but confused by all the trading options out there? Forex and CFD trading might be your answer, allowing traders to profit from price changes without owning the underlying assets.

If you’re interested in exploring the world of Forex line trading and CFDs, this blog will guide you through the basics of Forex and CFDs, their similarities and differences, and how to start trading them effectively.

Get ready to explore a new way to trade!

Understanding Forex and CFD Trading

Forex trading lets people swap one currency for another. The price they’re willing to sell it at is called the bid. This market is huge, letting folks buy and sell currencies all day, every day.

CFD trading is different but exciting too. It allows traders in Europe to make money off the changing prices of things like shares or gold without actually owning them. They use special contracts that track these price changes closely.

Both worlds have their own rules and playbooks. In Forex, you deal with pairs of currencies, focusing on their buying and selling prices. CFDs open up a broader menu – not just currencies but also stocks, commodities, and more can be traded through these contracts.

Traders need to stay sharp, considering costs like fees for holding onto trades longer than a day in CFDs or dealing with the spread between buying and selling prices in Forex.

Similarities Between Forex and CFDs

Forex and CFD trading both let traders predict price movements without owning the actual assets. They use margin and leverage, which means you can trade with more money than you have in your account.

These trades happen over the counter (OTC), not on a formal exchange. This setup allows for flexibility in trading hours and strategies.

Both methods involve leveraged derivative products, making it possible to profit from rising or falling markets. Traders use similar platforms for executing their trades, ensuring that they can switch between forex and CFDs easily.

A wide range of tradable assets is available, offering diverse opportunities without the need to transfer physical ownership of any asset.

Key Differences Between Forex and CFDs

Forex and CFDs differ in the range of tradable assets, as well as costs and fees. To learn more about these distinctions, continue reading!

Range of Tradable Assets

CFD trading opens up a vast world of assets beyond just currencies. Traders can explore and invest in shares, commodities like gold or oil, and even indices from global markets. This variety allows for diverse strategies and opportunities to profit from different sectors.

In contrast, forex trading is all about currency pairs. Traders speculate on the movement between two currencies, such as the US dollar and the euro. Although it may seem limited, this focus enables deep expertise in currency market dynamics.

Next, we’ll delve into the costs and fees associated with these trades.

Costs and Fees

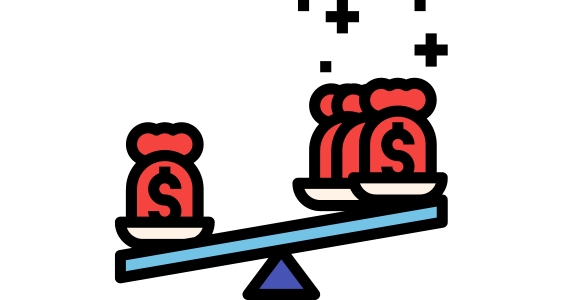

Understanding the costs and fees involved in trading is crucial for every trader. Here is a breakdown of the main expenses associated with Forex and CFD trading, summarized in a simple table format.

| Type of Trading | Spread | Commission | Financing Cost |

| Forex | Based on bid/ask price difference | None | None |

| CFDs | Based on bid/ask price difference | Possible in some cases | Applies in certain situations |

This table succinctly captures the essence of trading costs for both Forex and CFDs. It highlights the spread as a common cost in both types of trading. However, CFD trading may involve additional costs like commissions and financing costs under certain conditions. Despite these differences, it’s important to note that both trading approaches aim to minimize costs for the trader. Let’s now delve into how CFD trading works, exploring contract creation and trading examples.

How Does CFD Trading Work?

To trade CFDs, you create a contract with the broker and then profit from the price changes of the underlying asset. Dive into more details by reading on!

Contract Creation

Traders create CFD contracts with spread betting firms or investment banks. These contracts don’t have a fixed expiry date and are based on the underlying asset’s price movements. By entering into a CFD contract, traders can speculate on the future price of an asset without owning it, allowing them to potentially profit from both rising and falling markets.

The creation of CFD contracts is an agreement between the trader and the broker. It allows traders to benefit from leveraging and going short while engaging in speculative trading activities without actually owning the assets being traded.

Trading Examples

CFD trading allows investors to profit from price changes without owning the underlying assets. Here are some detailed trading examples:

- Buying a Stock CFD: If a trader believes that the price of a particular stock will rise, they can buy a stock CFD at the current price and sell it when they believe the price has peaked, profiting from the difference.

- Selling an Index CFD: When traders anticipate that the value of an index will decrease, they can sell an index CFD at the current price and buy it back at a lower price, benefiting from the variation.

- Currency Pair Trading: For instance, if a trader expects the Euro to strengthen against the US Dollar, they can purchase a EUR/USD CFD and then sell it once their target is met, capitalizing on the currency fluctuation.

- Commodity CFDs: Investors can speculate on commodity prices by buying or selling commodity CFDs based on their market projections, allowing them to benefit from market movements without owning physical commodities.

- Short-Term Trading: Traders may engage in short-term strategies within minutes or hours by taking advantage of small price movements in various markets using leveraged CFD products.

How to Trade Forex CFDs

To trade Forex CFDs, choose a currency pair, decide on Spot FX CFDs or CFD FX Options and open and monitor the trade. Read more to learn about maximizing your trading potential.

Choosing a Currency Pair

When selecting a currency pair for forex trading, consider major pairs such as EUR/USD and USD/JPY due to their high liquidity and volume. Focusing on one or two currency pairs like GBP/USD is advisable for new traders to gain in-depth knowledge and make informed decisions.

Understanding each currency’s economic indicators can aid in choosing the best pair aligned with market trends.

Deciding on a suitable currency pair is crucial for successful trading outcomes. Now, let’s delve into the essential aspects of spot FX CFDs or CFD FX options.

Deciding on Spot FX CFDs or CFD FX Options

Traders must consider their risk tolerance and trading strategy when choosing between Spot FX CFDs and CFD FX options. The former provides flexibility in entering and exiting trades, while the latter offers the right to buy or sell a currency pair at a predetermined price within a specific timeframe.

Analyzing market conditions and understanding personal trading goals are crucial for selecting the most suitable option.

– Opening and Monitoring a Forex CFD Trade involves following specific strategies to achieve successful outcomes.

Opening and Monitoring a Forex CFD Trade

To open a Forex CFD trade, choose the currency pair you want to trade. Enter the trade size and decide whether to buy or sell based on your analysis of the market. Once the trade is open, monitor the position regularly to stay informed about changes in market conditions.

- Keep an eye on economic indicators and news that may impact your chosen currency pair.

- Set stop-loss orders to limit potential losses and take-profit orders to secure profits.

- Monitor the trade for any signs of volatility or unexpected price movements.

- Stay updated on interest rate decisions and geopolitical events that could affect the currency pair.

- Regularly review your trading strategy and adjust your approach as necessary to optimize your trade.

Benefits of CFDs in Forex Trading

Leverage boosts trading power. Range of markets offers diverse opportunities.

Leverage

CFDs offer higher leverage than traditional trading, allowing traders to gain exposure to various markets with minimal capital. Standard leverage in the CFD market can be as low as a 2% margin, offering increased opportunities for trading with only a small portion of their own capital.

This enables traders to open positions and access markets that would typically require significantly more significant funding.

Leverage in CFD trading permits traders to use a smaller proportion of their own capital when initiating a position. This allows for increased flexibility and potential returns on investment, providing access to diverse trading opportunities that might otherwise be inaccessible due to financial constraints.

Range of Markets

CFD trading offers access to a diverse range of markets, including forex, stocks, indices, commodities, and even cryptocurrencies. Most brokers provide CFDs on various markets like commodities, indices, stocks, and metal markets.

This flexibility allows traders and investors to gain exposure to different financial markets through a single platform.

Traders can engage in CFD trading across multiple asset classes such as shares, indices or currency pairs. This means that they can profit from price changes without the need to own the underlying assets.

Going Short

Traders engaging in CFD trading have the advantage of going short, enabling them to profit from declining markets. This is made possible by selling a CFD contract without actually owning the underlying asset.

When the market price falls, traders can repurchase the CFD at the lower price, pocketing the difference as profit.

Furthermore, CFDs offer flexibility as they allow investors to trade on both rising and falling markets. By utilizing this feature effectively, traders can capitalize on various market conditions and potential opportunities for gains.

Tax Efficiency

CFD trading can offer tax efficiency, with potential tax deductions for losses incurred. It is important to have a clear understanding of capital gains taxes and how they apply to CFD trading.

Unlike other forms of trading, CFDs may provide traders with tax benefits due to their structure and classification.

When considering the tax implications of CFD trading, it’s crucial to seek professional advice based on individual circumstances. The possibility of tax-deductible losses in CFD trading adds another layer of appeal for traders looking for potential financial advantages in the market.

Conclusion

In summary, Forex and CFD trading offer opportunities for profit without owning the underlying assets. Traders can access global markets with leverage and speculate on price movements.

With the potential for both long and short positions, these trading methods provide flexibility to capture opportunities in various market conditions.

Understanding the differences between Forex and CFDs is key to developing a successful trading strategy while minimizing risks.

General Facts: Forex and CFD Trading

- CFD trading offers European traders and investors the opportunity to profit from price changes without owning the underlying assets.

- Forex trading, or FX trading, involves buying and selling different currencies with the aim of making a profit.

- CFD trading works using contracts that mirror the prices of financial markets, such as shares, indices, or currency pairs.

- Whether trading in cryptocurrency assets, Forex currency pairs, or ordinary stocks on the stock market, a CFD account on the CFD broker platform can be used.

- The forex market is the world’s most traded market with over $7.5 trillion being traded every day.

- CFD trading allows traders to speculate on the rising or falling prices of fast-moving global financial markets.

- Forex CFD trading involves understanding the differences between forex and CFDs, developing a trading strategy, and managing risks.

- CFD trading allows traders to access global markets with leverage, meaning you can gain a large exposure to a financial market while only tying up a relatively small amount of capital.

- Forex trading is the buying and selling of currencies to make a profit.

- CFD trading provides a flexible way to trade global markets with the ability to go long or short, and profit from rising or falling prices.

See Also: Forex Trading – Now Anyone Can Do It